IEA Says Oil Prices May Fall Even Further Before Supply Fades in 2016

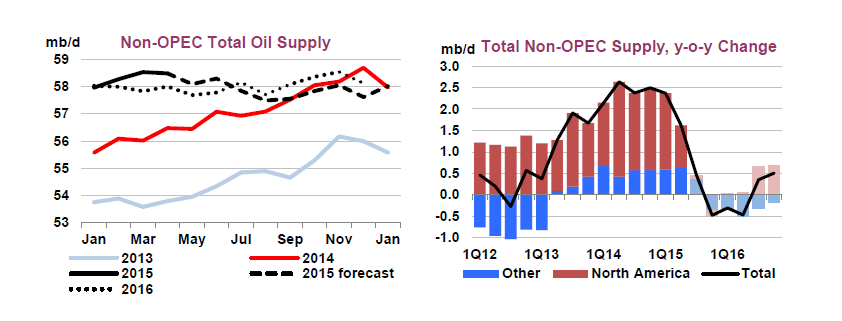

Oil prices may fall further as the world remains “massively oversupplied,” before markets tighten in 2016 when output growth outside OPEC grinds to a halt, according to the International Energy Agency.

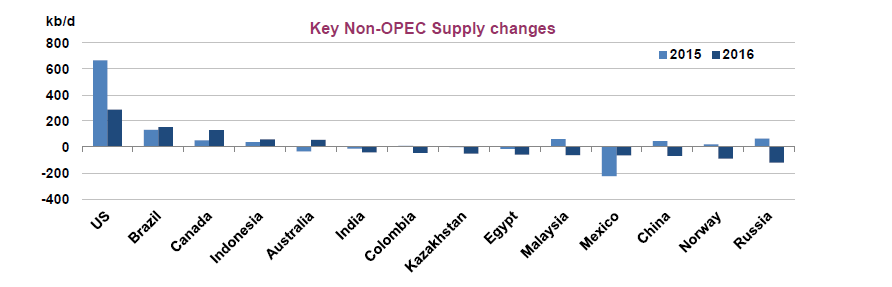

There will be no overall production growth outside the Organization of Petroleum Exporting Countries next year for the first time since 2008, according to the IEA. Growth in U.S. shale oil supplies will stagnate to the middle of 2016 while output declines in Russia, the Paris-based adviser said in its first detailed assessment of the year ahead. Global oil demand growth will slow, the agency predicted.

Chart: International Energy Agency

Oil-producing nations around the world are reeling after OPEC initiated a strategy in November to defend its share of global markets by pressuring rivals to curb output. Oil prices, about 45 percent lower than a year ago, may need to decline further to reduce the supply surplus, the IEA said.

“The bottom of the market may still be ahead,” said the agency, which advises 29 industrialized nations on energy policy. “Non-OPEC supply growth is expected to grind to a halt in 2016 as lower oil prices and spending cuts take a toll.”

Brent crude futures, a global benchmark, pared gains after the report. The August contract traded 9 cents higher at $58.70 a barrel at 1:49 p.m. on the London-based ICE Futures Europe exchange, having earlier risen as much as $1.05. The grade has lost 13 percent from this year’s peak in May.

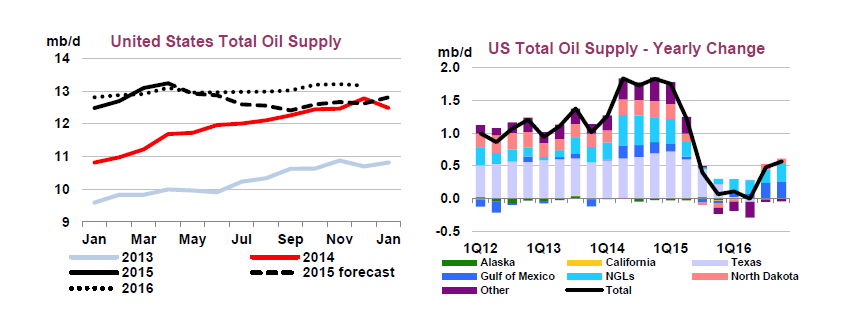

U.S. Slows

Chart: International Energy Agency

“In the short term, the report is definitely bearish” because of its assessment of a massive surplus, said Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd. in London. The 2016 numbers are supportive of prices because of the “huge swing” in the trend of non-OPEC production growth, she said.

U.S. production growth will slow to 300,000 barrels day next year from 900,000 a day in 2015, with gains in offshore production and supply of natural gas liquids. While “cost savings, efficiency gains and producer hedging” have helped shale drillers beat expectations so far, the nation’s boom can’t keep going at current prices, the agency said.

Chart: International Energy Agency

The halt in non-OPEC growth projected for 2016 contrasts with an expansion of 1 million barrels day this year and a “massive” 2.4 million in 2014, the IEA said. Russia’s production will slip next year to 10.86 million barrels a day from 10.98 million, the agency forecast.

OPEC Strength

The slowdown in supplies will increase reliance on OPEC in 2016, the IEA said. Production from the 12-nation group climbed to a three-year high of 31.7 million barrels a day in June as Iraq reached a record of more than 4 million a day and Saudi Arabia, the biggest member, added output.

That leaves total OPEC supplies about 1.4 million barrels a day higher than the average needed next year “and the group is not slowing down,” according to the IEA. This will potentially counteract the effect of weaker output elsewhere in rebalancing world markets, the agency said.

“The rebalancing that began when oil markets set off on an initial 60 percent price drop a year ago has yet to run its course,” according to the report. “Recent developments suggest that the process will extend well into 2016.”

Global oil demand growth will slow next year to 1.2 million barrels a day -- reaching 95.2 million a day -- down from an expansion of 1.4 million a day this year, according to the report. The increase in consumption peaked in the first quarter, temporarily boosted by an unusually cold European winter.

No comments:

Post a Comment